internet tax freedom act 2020

The Internet Tax Freedom Act ITFA enacted in 1998 was intended to protect the developing internet technology. The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would interfere with the free flow of interstate commerce over the internet.

Freedom Of Expression Online In 2022 Dw Observatory

The Permanent Internet Tax Freedom Act PIFTA.

. On February 14 2020 in Bd. Direct Federal Returns Always Free. Under the Internet Tax Freedom Act ITFA states who taxed Internet access before 1998 can continue taxing Internet access through June 30 2020.

105-277 imposed on state and local. 644 the Trade Facilitation and Trade Enforcement Act of 2015. Senate approved a permanent extension of the Internet Tax Freedom Act that was included in HR.

Hawaii New Mexico North. 105-277 imposed on state and local. Legislative Status and Background The Internet Tax Freedom Act of 1998 ITFA.

Internet Tax Freedom Acts prohibition against taxing internet access applies to all states beginning July 1 2020 On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the. ITFA which prohibited states and localities from applying taxes on internet access or imposing discriminatory digital-only taxes became permanent in 2016 but included a grandfather clause that allowed states with taxes existing before 1998 to keep that tax in place until. BPOL Tax and Internet Tax Freedom Act.

Free Federal IRS E-File. INTERNET TAX FREEDOM ACT. The ITFA allowed for certain states to be grandfathered in allowing states like Wisconsin to continue to impose sales tax on Internet access.

PIFTA now in effect states that no states or local areas can tax internet access. CL-2019-5800 the Circuit Court of Fairfax County issued a letter opinion granting Cox Communications motion for partial summary judgment and denying Fairfax Countys motion for summary judgment. File Simple or Advanced Taxes Now.

The bill also establishes an end date of June 30 2020 for the seven states that currently impose a tax on internet access. Under the TFTEA that right will be phased out by June 30 2020 and states like Texas in fact Texas more than any other state will feel the tax-revenue impact. The exemption is mandated by the Internet Tax Freedom Act ITFA which was first enacted in 1998 to encourage growth of the fledgling internet.

The IFTA included a grandfather clause which allowed states taxing Internet access at the time the bill was enacted to continue to do so. As of July 1 2020 those fees will be exempt. Since 1998 there have been multiple extensions of the Internet Tax Freedom Act and the grandfather clause.

Amends the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple or discriminatory taxes on electronic commerce. Ohio was one of those states. At the time no one knew what the internet could.

Caxcom LLC Case no. Starting July 1 2020 Internet access will no longer be subject to state and municipal sales tax. However the permanent extension of ITFA includes a provision that bans grandfathered states from taxing Internet access services after June 30.

06-02-2020 0 minute read. In 2016 Congress made the Act permanent and only extended the grandfather clause to June 30 2020. The Internet Tax Freedom Act ITFA passed in 1998 imposed a moratorium preventing state and local governments from taxing internet access.

Permanent Internet Tax Freedom Act. 105277 text PDF on October 21 1998 by President Bill Clinton in an effort to promote and preserve the commercial educational and informational potential of the Internet. 151 note preempts state and local.

On February 11 2016 the US. While the act furthers many important goals like ensuring that low-cost Internet access is available to low-income households the permanent extension of the ITFAs ban against. The bill also establishes an end date of June 30 2020 for the seven states that currently impose a tax on internet access.

Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin. Microsoft Word - Internet Tax Freedom Act 6-4-20 Author. 644 the Trade Facilitation and Trade Enforcement Act of 2015.

Sales Tax Ends On Internet Access Beginning July 1 2020. The move was intended to keep internet access from becoming overly expensive for consumers and to make it easier for providers to expand to rural areas. On June 30 2020 the grandfathering provisions of the Internet Tax Freedom Act ITFA 1 which permitted states that taxed internet access before the ITFAs enactment to continue doing so will expire.

The new legislation established a firm cease date of June 30 2020 to eliminate a grandfather provision for a handful of states that were still imposing taxes on internet access. However a number of important questions are left unanswered by lawmakers regarding its. Legislative Status and Background The Internet Tax Freedom Act of 1998 ITFA.

Hawaii New Mexico North Dakota Ohio South Dakota Texas and Wisconsin. The Act had a grandfather clause allowing states that already taxed Internet access to continue enforcing those taxes. The 1998 Internet Tax Freedom Act is a United States law authored by Representative Christopher Cox and Senator Ron Wyden and signed into law as title XI of PubL.

The Internet Tax Freedom Act of 1998 temporarily stopped states and local governments from imposing new taxes on Internet access and multiple or discriminatory taxes on electronic commerce. Under the Internet Tax Freedom Act ITFA states who taxed Internet access before 1998 can continue taxing Internet access through June 30 2020. The permanent Internet Tax Freedom Act ITFA 47 USC.

On February 11 2016 the US. The law bars federal state and local governments from taxing Internet access and from imposing discriminatory Internet-only taxes su. 151 note preempts state and local.

However the permanent ban ends the ability of these grandfathered. The original moratorium on such taxes enacted by the Internet Tax Freedom Act and extended multiple times IFTA was set to expire on October 1 2016. This tax alert summarizes the Internet Tax Freedom Acts ITFA grandfathering provisions new notice.

Grandfathering Provisions that Allowed Certain Jurisdictions to Tax Internet Access Set to Expire on June 30 2020 Deloitte US. Senate approved a permanent extension of the Internet Tax Freedom Act ITFA that is included in HR. However as of June 2020 we will probably hear less about the ITFA because the new law of the land.

Ad No Restrictions Forced Upgrades or Hidden Fees.

E Commerce In 2022 Issues Actors And Controversies

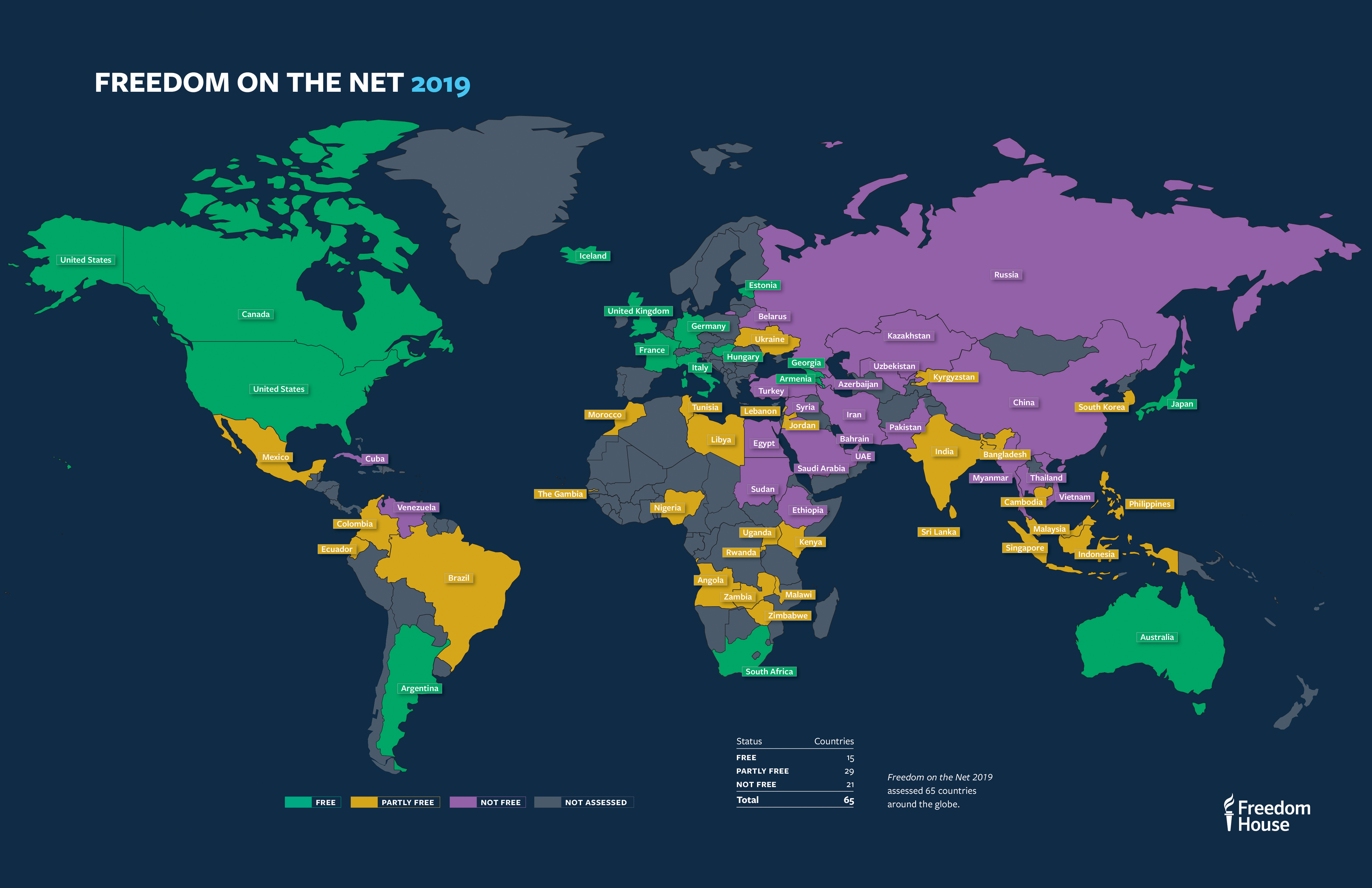

China Vs Taiwan Internet Freedom Hong Kong Doxing Law India Media Hacked October 2021 Freedom House

The Parliamentarian 2020 Issue Four Social Media And Democracy In The Commonwealth By The Parliamentarian Issuu

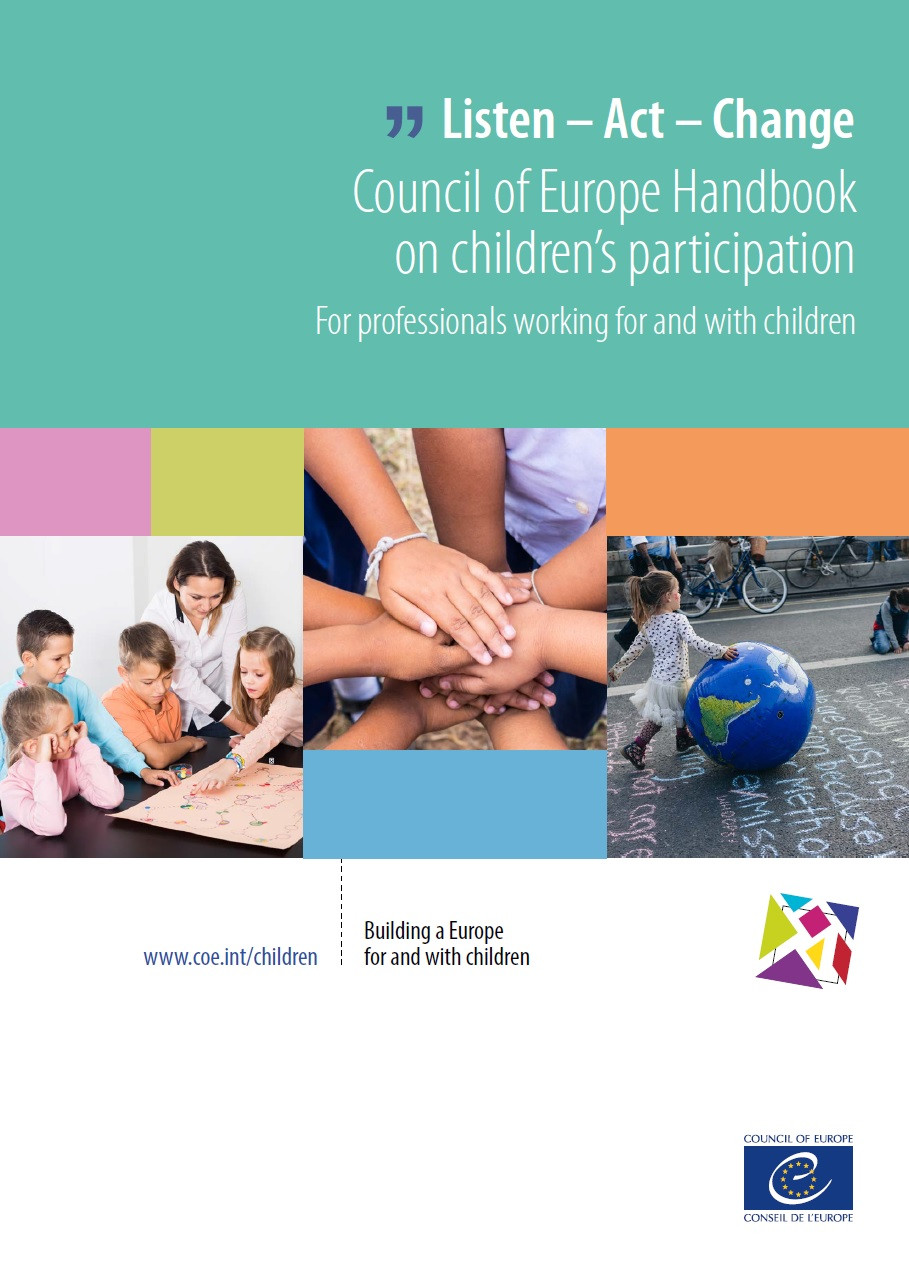

Listen Act Change Council Of Europe Handbook On Children S Participation 2020

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

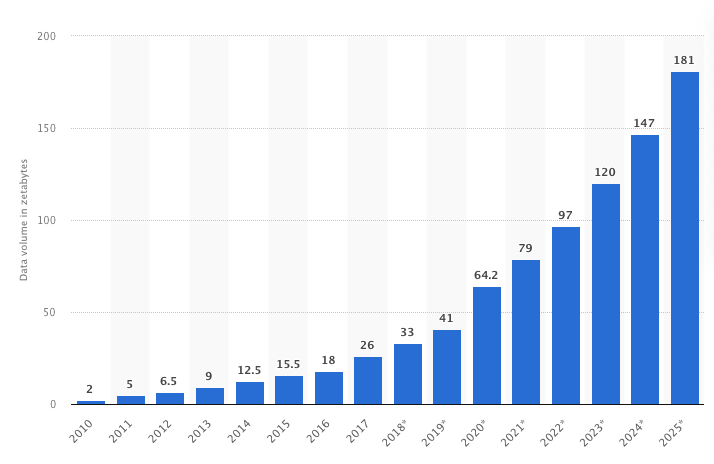

20 Digital Governance Keywords For 2020 Prediction Diplo

Government Internet Shutdowns Are Changing How Should Citizens And Democracies Respond Carnegie Endowment For International Peace

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

E Commerce In 2022 Issues Actors And Controversies

E Commerce In 2022 Issues Actors And Controversies

Uganda S Proposed Tax On Internet Data Threatens The Rights To Freedom Of Expression And Access To Information Article 19

Freedom Of Expression And The Internet Updated And Revised 2nd Edition

Internet Censorship 2022 A Global Map Of Internet Restrictions Comparitech